If you’ve ever felt abandoned in the middle of a software rollout or watched your HR system launch

Learn more

In today’s digital age, HR teams are under growing pressure to modernize. New HR platforms,

Learn more

When organizations launch a request for proposal (RFP) to select a human capital management (HCM)

Learn more

As we approach 2026, the role of Human Resources is transforming, not gradually, but fundamentally.

Learn more

Human Capital Management (HCM) has evolved far beyond a “nice-to-have” software tool. In today’s

Learn more

We recently hosted a webinar titled “Avoiding Common HCM Software Mistakes”, and what stood out

Learn more

In HR circles, you'll hear a lot about HRIS, HRMS, talent platforms, and HCM, sometimes

Learn more

As ACA compliance continues to evolve, HR teams are facing a more complex and higher-stakes

Learn more

For HR professionals in the U.S., managing ACA compliance can feel like juggling flaming torches

Learn more

Now that you’ve scoped the countdown, it’s time for the next step: taking action and planning for

Learn more

As the end of the year approaches, HR and payroll teams face one of their most intensive windows:

Learn more

Retirement rules got you scratching your head? Don’t worry, Greg Duval, COO of FUSE, has your back.

Learn more

HR professionals are often the silent guardians of employee financial well-being. Payroll,

Learn more

If you work in HR or payroll, you’ve likely heard the buzz around the One Big Beautiful Bill Act

Learn more

Every new law brings questions. For HR professionals and payroll teams, that’s especially true

Learn more

Changes big and small tend to land on HR’s doorstep and the One Big Beautiful Bill Act (OBBBA) is

Learn more

You nailed communication (Part 3), you energized benefits (Part 2), you tamed chaos (Part 1), but

Learn more

You know that moment when you finally send out your open enrollment email … and hear absolutely

Learn more

Open enrollment is often seen as HR’s annual fire drill. But here’s a thought: what if instead of

Learn more

If you’ve ever lived through open enrollment season, you know it’s not all pumpkin spice and cozy

Learn more

In manufacturing, collective bargaining agreements (CBAs) define the rules of engagement between

Learn more

As nonprofits grow, so can the challenges behind the scenes. More employees, more programs, more

Learn more

Today, manufacturers face complex labor dynamics, including shifting schedules, union rules, and

Learn more

Payroll is one of the more important and more stressful tasks nonprofit leaders face. Between tight

Learn more

The Fair Labor Standards Act (FLSA) sets the rules for minimum wage, overtime pay, and employee

Learn more

Are you wondering how long it takes to implement HR and payroll software? The answer depends on

Learn more

Implementing an HCM system can feel overwhelming. It doesn’t have to be with the right strategy and

Learn more

The best place to start when choosing HR software is with your goals. Before you compare features

Learn more

Change is a constant in today’s workplace. Whether that may be rolling out new technology, shifting

Learn more

You know your current HR or payroll system isn’t cutting it. Maybe it’s clunky. Maybe it’s manual.

Learn more

The rise of AI is transforming the workplace at a pace few anticipated. From automating routine

Learn more

Companies often need to make tough decisions about their workforce in the face of changing market

Learn more

Recruitment is at the heart of every organization’s success, yet traditional hiring processes often

Learn more

In payroll management, accruals keep track of employee benefits like paid time off (PTO) and sick

Learn more

Have you ever struggled to manage multiple logins across various HR and payroll systems? In today’s

Learn more

Companies must adapt to new challenges and evolving market conditions to stay competitive in

Learn more

Managing Time, Attendance, and Scheduling in 24/7 Healthcare Environments Hospitals don’t close for

Learn more

HR leaders in healthcare navigate some of the most complex challenges in the workforce. Every shift

Learn more

In healthcare, time isn’t flexible—and neither are the demands on your workforce. While nurses

Learn more

HR used to rely on instincts and experience to make workforce decisions. Now, data is changing the

Learn more

Resumes are screened in seconds, engagement issues flagged before they escalate, and workforce

Learn more

Remote work has transformed from a temporary solution into a long-term expectation. However, as

Learn more

Finding the right talent has become both a science and an art in today's society. Traditional

Learn more

Hiring managers and recruiters share the same goal: securing top-tier candidates quickly and

Learn more

Job descriptions shape the hiring experience, influencing who applies and how well candidates match

Learn more

Companies invest millions in training programs yearly, yet studies show that 70% of employees

Learn more

Administrative tasks are the silent engine of HR operations, but when managed manually, they can

Learn more

It’s no secret that effective onboarding is the critical first step in employee retention and

Learn more

Traditional performance reviews often fail to meet expectations. They’re infrequent,

Learn more

Performance reviews are a tool for nurturing employee growth, aligning them with company goals, and

Learn more

The interview process is a critical part of hiring that shapes candidates' perceptions of your

Learn more

Companies constantly seek innovative ways to attract and retain top talent in today's competitive

Learn more

Employee productivity is the motor that drives any successful business, influencing everything from

Learn more

The payroll landscape is evolving, driven by the demand for flexible, real-time, and

Learn more

As businesses seek new ways to support their employees’ financial well-being, concepts like earned

Learn more

In today's competitive job market, attracting and retaining top talent is more challenging than

Learn more

As the year draws to a close, businesses everywhere are gearing up for the flurry of year-end

Learn more

The COVID-19 pandemic triggered a massive shift to remote work almost overnight, transforming the

Learn more

Employee retention is a critical aspect of maintaining a successful business. While various factors

Learn more

Today's work culture is more demanding and fast-paced than ever before, often straining employees'

Learn more

In today's competitive job market, having a strong employer brand is crucial for attracting and

Learn more

In the ever-evolving world of work, company culture has become a critical factor in business

Learn more

In the fast-paced business world, having an efficient and reliable payroll system is not just a

Learn more

Succession planning software is designed to help organizations identify and develop internal

Learn more

Let me start with a cautionary tale that's been played out far too often. A new business venture

Learn more

Discover the benefits of implementing mentorship programs for employees and how they can contribute

Learn more

Explore the critical role HR plays in fostering employee learning and development within

Learn more

Discover the numerous advantages of implementing a Learning Management System (LMS) in your

Learn more

Discover the key differences in payroll and HR requirements between companies that predominantly

Learn more

Discover the significance of managing time off requests to ensure a productive work environment and

Learn more

Understanding what an Enterprise Resource Planning (ERP) system and an all-in-one payroll and HR

Learn more

Unlock the potential of HR analytics to revolutionize your hiring process HR analytics has the

Learn more

Understanding the Limitations of Big-Name Payroll and HR Companies Many businesses are finding that

Learn more

As you enter the fourth quarter of the year, there’s a lot that HR needs to get done. It’s not just

Learn more

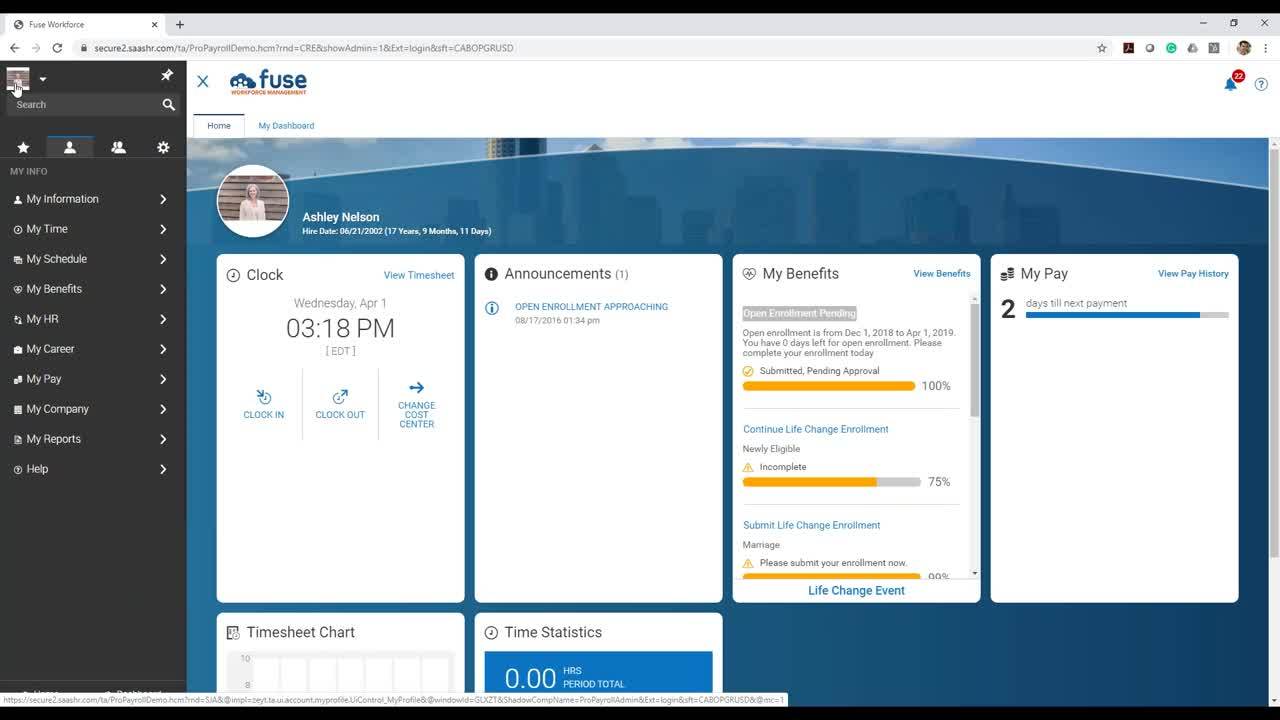

Discover how implementing an employee self-service (ESS) portal can significantly enhance employee

Learn more

Discover the essential strategies top HR recruiters use to attract and hire the best talent in any

Learn more

Artificial Intelligence (AI) is making its mark across various aspects of our professional lives,

Learn more

At the onset of the global pandemic, a significant transformation took place in the corporate

Learn more

In the world of Human Resources, we often hear new buzzwords. Everyone's been talking about

Learn more

Seasonal hiring is a problematic situation for businesses to navigate. Done right, it can help your

Learn more

An often overlooked area of recruiting is how to find hourly employees. Hourly workers are becoming

Learn more

In today's competitive employee marketplace, retaining young talent like recent college graduates

Learn more

In today's rapidly evolving world, diversity isn't just about filling a quota. It's a dynamic

Learn more

Recruiting continues to be a fundamental pillar of human resources management. An organization is

Learn more

In the world of human resources, there are different types of software systems that help manage

Learn more

Employee retention is a top priority for organizations in today’s competitive market. High turnover

Learn more

Employee retention is a critical factor for any organization's success. Losing valuable employees

Learn more

Employee retention is a critical factor in the success of any organization. High employee turnover

Learn more

In recent years, the concept of relational human resources (HR) has gained increased attention

Learn more

What is an HRIS Integration? A Human Resources Information System (HRIS) integration involves

Learn more

Understanding employee satisfaction is essential for today’s economy where we have people coming

Learn more

Training is one of the most effective ways to improve employee performance. It is also

Learn more

No matter the size of your organization, one metric you can't shake free of is worker productivity.

Learn more

Talent retention is a significant concern for organizations, so it's important to understand the

Learn more

Creating a diverse workforce is important for any business to thrive. As such, many companies

Learn more

While understanding what it costs to hire an employee has always been important, as we look at

Learn more

A key component of effective workforce management is staying on top of critical dates and

Learn more

Building a culture that incorporates diversity, equity, and inclusion (DEI) is critical to

Learn more

When the pandemic began, many organizations were forced to send employees home, whereas others had

Learn more

Employee onboarding is so much more than the old-fashioned notion of orientation. Unlike a single

Learn more

Helping employees reach their full potential and career goals is essential to support a positive

Learn more

Performance reviews—whether conducted annually, quarterly, or on some other schedule—are an

Learn more

Though you probably offer a combination of constructive feedback and coaching to employees, there

Learn more

Update: As of July 1, 2024 changes have been implemented to the Fair Labor Standards Act. For most

Learn more

Creating a highly engaged workforce has been a longtime goal for many organizations, as engaged

Learn more

Affordable Care Act (ACA) tracking is a must for employers, but what are the key components that

Learn more

Update: As of July 1, 2024 changes have been implemented to the Fair Labor Standards Act. For most

Learn more

The latest advances in modern technology mean you now have access to dynamic tools that support a

Learn more

Just about every talent management activity generates data. From the moment candidates apply to the

Learn more

A human resources business partner (HRBP) is a critical member of the HR team, helping the

Learn more

Update: As of July 1, 2024 changes have been implemented to the Fair Labor Standards Act. For most

Learn more

The Affordable Care Act (ACA) became law in 2010, and it has since made healthcare more accessible

Learn more

An essential part of effective payroll management is periodically auditing your payroll policies

Learn more

A unified workforce management system ties together all of the core elements of a talent management

Learn more

Whether you have a few non-exempt employees earning overtime or many more, managing overtime costs

Learn more

When you have a mobile workforce, some or all of your employees perform their duties outside of a

Learn more

Even with a solid payroll process in place, payroll errors still occur. Miscommunication between HR

Learn more

Reliable HR metrics help you understand the success of people initiatives, as well as their

Learn more

Errors and delays in payroll can be frustrating for everyone—payroll staff, HR, and the impacted

Learn more

Having an accurate count of employee hours enables you to manage what is likely your organization’s

Learn more

Getting payroll right is essential for delivering an exceptional employee experience and staying in

Learn more

For busy HR and payroll professionals, every month of the year brings new deliverables, and there

Learn more

Effective payroll management requires making sure your employees receive correct payments, on time,

Learn more

Keeping track of your manufacturing labor force requires specific tools and resources to help you

Learn more

How and where you store HR data is more important than you might think. It impacts the efficiency

Learn more

In an area as broad as HR, it’s easy to get pulled in several different directions. When running a

Learn more

Performance reviews can take many forms, from informal weekly check-ins to quarterly or

Learn more

Preparing your workforce to meet the challenges of tomorrow requires a robust talent development

Learn more

When you have a highly engaged workforce, your organization is in a better position to achieve its

Learn more

As a human resources leader, you’re responsible for delivering programs that improve the employee

Learn more

Payroll duties require careful strategy, teamwork, and execution. You have to deal with numbers and

Learn more

Whether you’ve been in Human Resources for 25 years or you’re just starting out your career, the HR

Learn more

In the market for a new payroll provider? Ready to move to the cloud? You've got some research

Learn more

Your payroll manager is key to your organization’s smooth operations. After all, they are

Learn more

Your payroll provider is responsible for helping you deliver accurate employee pay, but if the

Learn more

From the moment an employee becomes part of your organization, they rely on support from your HR

Learn more

An integrated HR payroll system is a software solution that merges payroll and HR activities for

Learn more

When you manage several HR processes at once, you rely on automation technology to get more

Learn more

As an HR professional, you’re responsible for coordinating everything that comes along with human

Learn more

As countries around the world enforce stay-at-home orders, employees across industries and

Learn more

The most productive HR teams rely on effective business reporting, but with so many staff members

Learn more

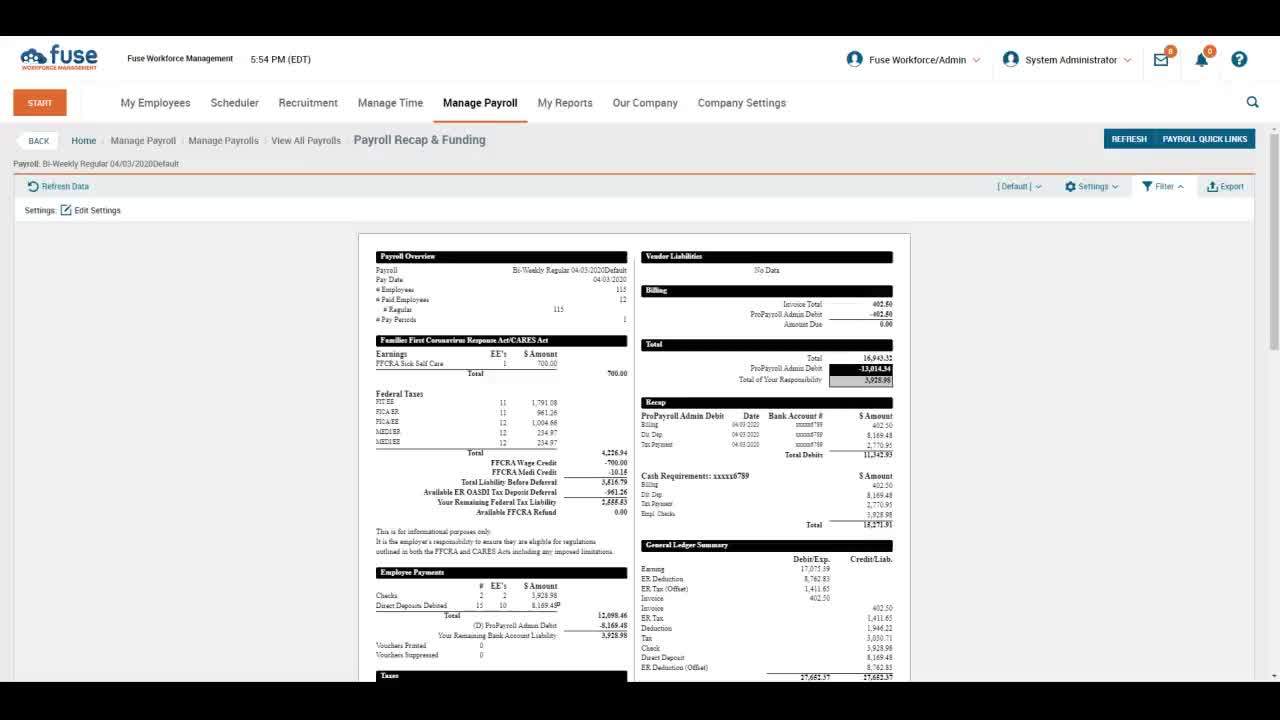

On April 1st, we held a webinar to discuss the details of the Families First Coronavirus Response

Learn more

With the holidays behind us and the new year in full swing, many workplaces may be actively trying

Learn more

It’s possible to attach a metric to just about any HR activity. However, not all HR metrics deliver

Learn more

Losing your best employees is a bummer. It takes a lot of time and resources to find a replacement

Learn more

With the start of the new year, it’s time to start looking ahead to what the next 12 months have in

Learn more

This year has been an eventful one for workplaces all over the United States. Between legislative

Learn more

For time-strapped HR and payroll managers, every day at work is a juggling act. The mental load of

Learn more

It’s no secret that social media has become part of most peoples’ daily routines in the last few

Learn more

Update: As of July 1, 2024 changes have been implemented to the Fair Labor Standards Act. For most

Learn more

With Thanksgiving coming up later this week, the holiday season is in full swing. In offices around

Learn more

Many modern employers are focused on improving employee engagement metrics, and for good reason:

Learn more

Elementary school teachers and parents of young children have long been known to use sticker charts

Learn more

As competition for the best talent heats up in most industries, it’s important for recruiters and

Learn more

When an employee chooses to leave your company for another opportunity, it’s understandable that

Learn more

When your best employees leave, they don’t just take their skills and training with them; they also

Learn more

Autumn doesn’t just bring change to the leaves outside; there’s plenty of change happening in

Learn more

The Occupational Safety and Health Administration (OSHA), which falls under the larger umbrella of

Learn more

For anyone who loves variety and thrives in a busy job, working in HR may be a great fit. The role

Learn more

Distraction is an epidemic in nearly every modern workplace. Between the rising popularity of open

Learn more

For some people, the end of August means back-to-school shopping and parent-teacher conferences.

Learn more

If you’ve been in HR for any amount of time, you’re aware of the myriad problems associated with

Learn more

As most HR managers can attest, employee turnover is pricey. In addition to the cost of lost

Learn more

Even in the best of times, keeping your recruiting operation running smoothly can be a challenge.

Learn more

As the dog days of summer wear on and the Supreme Court is done handing out verdicts about

Learn more

What’s the first thing you do before you buy a new piece of furniture? Visit a new restaurant? Book

Learn more

In 2018, a Bureau of Labor Statistics survey found workers were quitting their jobs at the highest

Learn more

Most employees do their best work (and enjoy the greatest sense of satisfaction) when they’re

Learn more

Q2 is coming to a close and summer is officially in full swing. As you reflect on the first half of

Learn more

Recruiting, hiring, and onboarding new talent is a time-consuming and expensive process. Sourcing

Learn more

Being responsible for hiring new employees means exercising due diligence to ensure the

Learn more

As an HR leader, you’re accustomed to helping others develop their skill sets and ascend through

Learn more

As summer draws closer and temperatures rise, May’s roundup proves things are heating up for the HR

Learn more

When it comes to making hiring decisions, most employers begin by evaluating hard skills —

Learn more

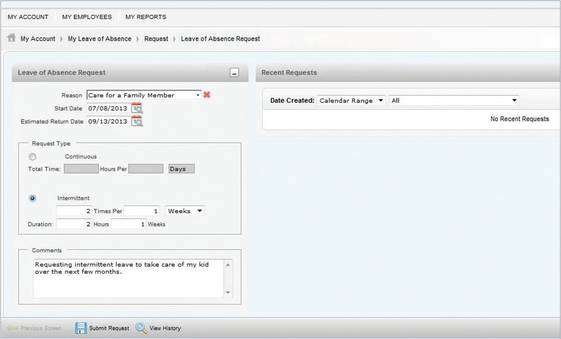

If administering the Family Medical Leave Act (FMLA) gives you an enormous headache, you’re not

Learn more

As an HR expert, your hiring decisions often hinge on a candidate’s performance in their job

Learn more

As we kick off the second quarter and resurface after a strenuous tax season, HR leaders are

Learn more

When legal conflicts arise between employees and employers — such as misconduct or a breach of

Learn more

Working in human resources is an enriching and rewarding career that allows you to make a

Learn more

As we round out the first quarter of the year and head into tax season, there are lots of changes

Learn more

When the COVID-19 pandemic began in early 2020, an unprecedented number of employees were sent to

Learn more

As a busy HR professional, finding time for career development can be challenging. While there are

Learn more

For most HR managers and company leaders, staying in compliance with employment law is a high

Learn more

The hiring process is crucial to the success of your workforce, especially when you’re filling an

Learn more

Most people who take pride in their work want to become more efficient, more effective, and

Learn more

Performance reviews can be a time for of delicate conversations, honest feedback, and thoughtful

Learn more

When you’re recruiting and hiring new employees, the right skills and experience are probably at

Learn more

With the first month of a new year coming to a close, employers are starting to get a feel for

Learn more

Happy New Year! As you’re putting together a list of resolutions, boosting your career as an HR

Learn more

You’ve made it through the holiday season: the company parties, the seasonal workers, the tricky

Learn more

Over the past few years, we’ve seen a big shift in the way people work due to changes in culture,

Learn more

Labor headwinds like demographic shifts and changing employee expectations have kept HR managers

Learn more

Read part 8: How an HCM system can improve productivity for HR, part eight: Retention While you

Learn more

The holiday season can be a tricky time for HR professionals and company leaders. Everyone on

Learn more

We’ve officially entered the holiday season, and we’re within striking distance of the new year.

Learn more

Read part 7: How an HCM system can improve productivity for HR, part seven: Compliance The grass

Learn more

If you’re in HR or payroll, you’re no stranger to compliance management, forms, and

Learn more

Read part 6: How an HCM system can improve productivity for HR, part six: Benefits Management

Learn more

With all the time-sensitive tasks HR managers are responsible for, it’s understandable that

Learn more

If October seems like the month for scary tricks, don’t forget there’s always something to sweeten

Learn more

HR managers, gather ‘round the fire for a truly scary ghost story. You’re trying to hire a few

Learn more

Traffic patterns, school schedules, family obligations, and doctor’s appointments can all break the

Learn more

Fuse Workforce Management has been identified as one of the best HR and Payroll Management Suites

Learn more

Making important decisions about employee benefits, like choosing health insurance packages, can be

Learn more

Happy National Payroll Week! All week long, we’re celebrating our beloved payroll professionals who

Learn more

Taking too long to hire the right person for a vacant position is almost guaranteed to cause

Learn more

A lot of trends between generations in the workforce have emerged in the past few years: Baby

Learn more

In this summer edition of the HR Roundup, a technology company inspires vacation for employee

Learn more

Update: As of July 1, 2024 changes have been implemented to the Fair Labor Standards Act. For most

Learn more

What happens when state law and federal law disagree? Today in the U.S., over 20 states have laws

Learn more

Read part 4: How an HCM system can improve productivity for HR, part four: Payroll If you hear

Learn more

When people talk about making lateral career moves, the response from friends, family, and mentors

Learn more

The workforce is paradoxically both more dispersed and more connected than ever before. A manager

Learn more

Read part 3: How an HCM system can improve productivity for HR, part three: Training To many of us,

Learn more

In any role, the first few weeks are a virtual minefield of awkward experiences and newbie

Learn more

This April, we saw people take action for civil and labor rights, moving the tides in the HR

Learn more

When President Clinton first signed the Family and Medical Leave Act (FMLA) into law in 1993, the

Learn more

Read part 2: How an HCM system can improve HR productivity, part two: Onboarding So you’ve

Learn more

For new employees, the first few days and weeks on the job are crucial. So much of their future job

Learn more

Spring is coming, and there’s fresh news in the HR landscape. With March Madness over, there’s

Learn more

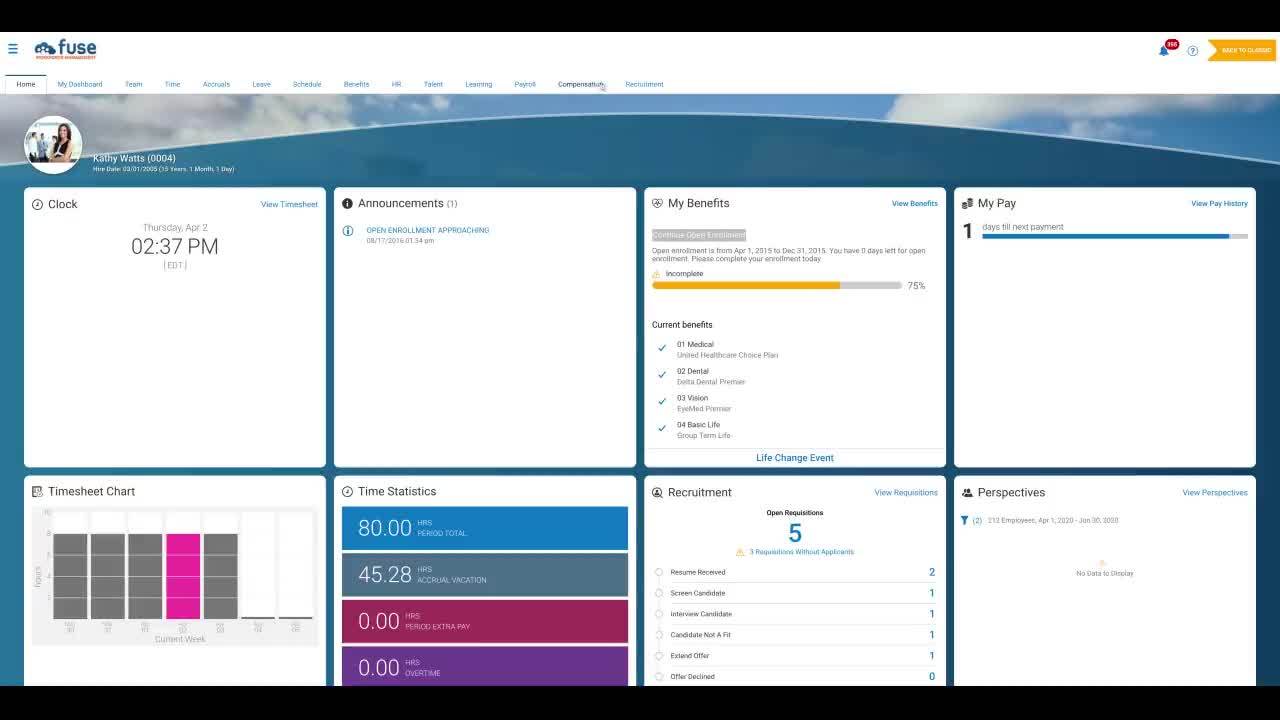

On the Fuse HR & Payroll blog, we’ve talked a lot about the many benefits of a human capital

Learn more

Read part 1: How HCM system can improve HR productivity: recruiting + hiring As an HR manager,

Learn more

In the past several decades, women have made huge strides in the workplace. All it takes is

Learn more

Next hurricane season, don’t expect your pizza delivery in the midst of an evacuation. Despite a

Learn more

You’ve probably noticed that the modern American workforce is changing. That may be partly due to

Learn more

The national conversation about sexual misconduct seems to have reached a flashpoint in the past

Learn more

We’re one month into 2018, and there’s plenty of HR news to report. For many workers across the

Learn more

At the end of 2017, the IRS began sending Letter 226J to Applicable Large Employers (ALEs) as a

Learn more

Fuse Workforce Management has been identified as one of the best software and services companies in

Learn more

In the 1970s, the Boston Symphony Orchestra (BSO) had a problem: an almost all-male orchestra. This

Learn more

As we closed out 2017, a wild year for regulatory changes and workplace legislation, we witnessed

Learn more

Don’t you love the beginning of another new year, with a blank calendar full of potential? By now

Learn more

To say that 2017 has been a turbulent year for many HR managers would be an understatement. Between

Learn more

Keeping up with the news on the Affordable Care Act is difficult, and maintaining ACA compliance

Learn more

As 2017 draws to a close, it’s time for leaders in every workplace to evaluate what’s worked well

Learn more

Lately, it seems you can’t look at the news without another sexual harassment scandal popping up.

Learn more

It’s that time of year again! Our HR and Payroll calendar has become a favorite among our blog

Learn more

This time of year, there’s an extremely contagious little bug that gets around in crowded places,

Learn more

While the future of healthcare in America has been uncertain for most of this year, the ACA 2017

Learn more

Since 1919, several allied countries who participated in World War I have observed November

Learn more

It’s long been a key feature of the postwar American dream: hardworking Americans look forward to

Learn more

Company leaders are (rightly) preoccupied with the buzzy concept of “corporate culture” these

Learn more

The Ban the Box movement is a grassroots effort aimed at changing hiring practices that make it

Learn more

From natural disasters to last-minute repeal efforts, September has been full of buzzworthy news.

Learn more

Update: As of July 1, 2024 changes have been implemented to the Fair Labor Standards Act. For most

Learn more

In past articles, we’ve discussed the importance of having ongoing discussions about employee

Learn more

Happy National Payroll Week! Since its founding by the American Payroll Association in 1996, NPW

Learn more

Summer is coming to an end and school is back in session. In the spirit of learning, let’s take a

Learn more

While it seems a lot is up in the air with healthcare in America, employers are asking about the

Learn more

This month, all eyes have been locked on the Senate. Debates surrounding the Affordable Care Act

Learn more

In 1990, the Americans with Disabilities Act (ADA) was signed into law, prohibiting employers,

Learn more

Update: As of July 1, 2024 changes have been implemented to the Fair Labor Standards Act. For most

Learn more

If you’re like many other HR professionals, recruiting, hiring, onboarding, training, and managing

Learn more

June marked the official beginning of summer—but that has not slowed down the happenings in the

Learn more

Get hired, learn your job and prove yourself, get promoted, prove yourself in that role, get

Learn more

If you’re a recent college graduate, things are looking up for you—much better than your Millennial

Learn more

Most employers have experienced how challenging it can be to keep employees engaged in the long

Learn more

What’s happening in the world of HR this month? Congress has been busy developing, refining, and

Learn more

Maybe it’s medical advancements that allow people to stay healthier and live longer. Maybe it’s the

Learn more

It's time for another HR Roundup of the latest HR news and trends. This month, we review the Trump

Learn more

When an employee chooses to leave your organization– either for a new job elsewhere, or because

Learn more

As we approach the summer break, more and more college students will start hunting for internship

Learn more

What’s been happening in the world of HR lately? Honestly, what hasn’t? If you’ve been keeping an

Learn more

As Women’s History Month draws to a close, it’s a good time to reflect on and celebrate the

Learn more

"Corporate culture" has become such a common HR buzzword that it may elicit some eyerolls from

Learn more

We all know that staying informed about what's going on in our industry is important. But in the

Learn more

A job application is the first contact many companies will have with potential future employees or,

Learn more

We can all agree that 2017 has turned out to be quite a year so far. A lot remains in question

Learn more

Sometimes setting goals for employees seems like an afterthought tacked onto the performance review

Learn more

In the past several years, more companies have started to employ a blended workforce, whether they

Learn more

While many of us were focused on year-end processes and keeping employees in check at the company

Learn more

Wellness programs have steadily grown in popularity in the last few years. According to a 2015

Learn more

At the beginning of this year, we published an article predicting workplace trends to watch for in

Learn more

There’s nothing dull about Human Resources these days. This fall has boasted a lot of change and

Learn more

Whether or not you believe in making new year’s resolutions, the end of the year can be a

Learn more

Finally, a compliance calendar for HR and Payroll! If you've ever wondered how to stay on top of

Learn more

November is here and everything year-end seems to be right around the corner. But before we dive

Learn more

While the prospect of creating or updating your paid time off policy may seem like a simple matter

Learn more

Before we get too lost in our PSLs and flannel shirts, let's talk about September. What a month in

Learn more

Monitoring employee engagement should be part of any productive organization. Not only do engaged

Learn more

Update: As of July 1, 2024 changes have been implemented to the Fair Labor Standards Act. For most

Learn more

What’s new in HR news this month? The IRS and the DOL gifted us with new forms and posters for 2017

Learn more

Though it seems we’ve only just wrapped up ACA reporting in 2016, we’re already looking ahead to

Learn more

Bad news: sometimes, your most productive, positive, engaged employees will leave your company. It

Learn more

Update: As of July 1, 2024 changes have been implemented to the Fair Labor Standards Act. For most

Learn more

Not long before summer’s start, the DOL announced the final rule for overtime and white-collar

Learn more

We may have barely made it through the 2016 deadline for ACA reporting but it’s time to start

Learn more

If you’re planning to expand your workforce, first of all: congratulations on the growth! But

Learn more

The reporting deadline for Form 1094-C and 1095-C electronic filing is Thursday, June 30, 2016. Is

Learn more

Update: As of July 1, 2024 changes have been implemented to the Fair Labor Standards Act. For most

Learn more

As of the beginning of 2016, your company is responsible for proving compliance with the Affordable

Learn more

While some companies have taken these inherent flaws in the process as a sign that they need to

Learn more

Update: As of July 1, 2024 changes have been implemented to the Fair Labor Standards Act. For most

Learn more

Once again, the time has come for another roundup of what's been happening in the world of Human

Learn more

HR managers routinely identify employee reviews as their least favorite part of the job. To most

Learn more

The Department of Labor’s proposed FLSA changes could change exemptions for as many as 5 million

Learn more

Here’s what you need to know about Human Resources lately. This article recaps recent HR news

Learn more

Raise your hand if you enjoy managing the annual employee review process. (Cue crickets). Nobody

Learn more

Finding the right talent for your company is a challenge even in the best of times. But with the

Learn more

For an HR manager, the onboarding process can potentially be a clipped, formal set of necessary

Learn more

There is a lot of information out there and it’s easy to get lost in the mix of it all. As a

Learn more

The process of finding the right employees for your organization is never a particularly easy one.

Learn more

If you’re trying to follow payroll best practices, you know manual payroll is a thing of the long

Learn more

The process of training new employees has so many moving parts that any company can easily let a

Learn more

An employee’s first few days are such a crucial and potentially awkward time for them. We’ve all

Learn more

The buzzword in benefits and compensation training these days is Total Rewards. In the competition

Learn more

Looking for the 2017 HR & Payroll Compliance Calendar? It's right here! We’re several weeks into

Learn more

Last week, the IRS opened its doors to begin receiving tax forms for the 2015 calendar year.

Learn more

We don't like to talk about ourselves much—we're here to serve you by streamlining your HR and

Learn more

The US Treasury and IRS recently announced extensions for Affordable Care Act reporting. Previous

Learn more

Much ink has already been spilled about what we’re supposed to anticipate in HR departments for the

Learn more

With 2016 just around the corner, you may be thinking of some personal and professional New Year’s

Learn more

Editor's Note: Since the publishing of this article, the IRS and U.S. Treasury extended reporting

Learn more

Editor's Note: Since the publishing of this article, the IRS and U.S. Treasury extended reporting

Learn more

A lot goes into ACA compliance, but many employers fear the financial penalties most. Are you aware

Learn more

Editor's Note: Since the publishing of this article, the IRS and U.S. Treasury extended reporting

Learn more

Shopping around for the right time and attendance software is no easy task. There are a lot of

Learn more

Consequences for ACA noncompliance have employers and human resources staff on their toes about

Learn more

Imagine showing up to a party where you know absolutely no one. Although you’ve been invited to the

Learn more

Pay day. A day to count down to and celebrate, right? The anticipation, the joy, the money! While

Learn more

Update: As of July 1, 2024 changes have been implemented to the Fair Labor Standards Act. For most

Learn more

Affordable Care Act (ACA) compliance and reporting—don’t do it right and your business will face

Learn more

With healthcare costs on the rise and large companies like Google offering monstrous employee perks

Learn more

It’s awkward. It’s uncomfortable. But at some point or another, you have to do it. While firing an

Learn more

Ah, the unpaid summer internship. For many college students, it’s viewed as a rite of passage, a

Learn more

The Department of Labor released its much-awaited proposals to the overtime rules in the Fair Labor

Learn more

The Fair Labor Standards Act of 1938 was a major win for workers in the United States. It

Learn more

Is your company’s push for employee engagement burning out your best people? Burnout happens when

Learn more

Annual performance reviews can be a source of dread for many supervisors. What could possibly be

Learn more

Hiring new college graduates is a great strategy for lots of reasons. They’re eager to get work

Learn more

Effective July 1, 2015, the Healthy Workplaces, Healthy Families Act of 2014 will impose new paid

Learn more

ProPayroll today announced the latest release of the Fuse Workforce Management suite - including

Learn more

ProPayroll Further Positioned to Capitalize on SMB Market with Workforce Management Platform

Learn more

appPicker.com has selected TotalHRWorks, ProPayroll’s mobile app, as a top app for Employee

Learn more

ACA Mandates Delayed for Employers with 50-99 Employees until 2016, and Requirements are Lightened

Learn more

Proactively manage ACA compliance across your entire workforce.

Learn more

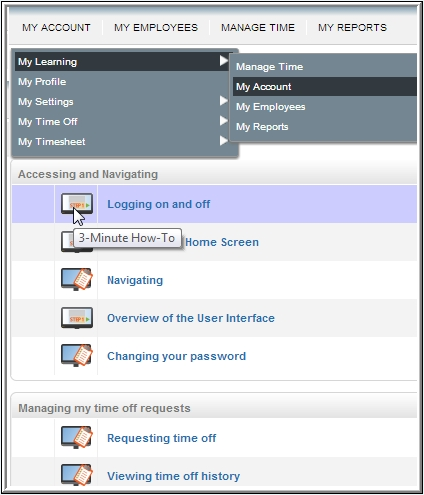

ProPayroll is excited to announce that we have released KnowledgePass to all clients and their

Learn more

As of October 1st, 2013, due to the government shutdown, The Department of Homeland Security will

Learn more

Please take note of the following changes to E-Verify guidelines in both Georgia and North

Learn more

ProPayroll Inc. today announced a series of enhancements to its fast-selling cloud workforce

Learn more

The term “Fiscal Cliff” was coined to refer to the convergence of several major events at the close

Learn more

E-Verify is now fully integrated into ProPayroll’s Workforce Management platform. E-Verify is a

Learn more

The Federal Reserve will be closed on Monday, October 8th in observation of Columbus Day. Follow

Learn more

The laws in the following states expressly permit, or can be interpreted as permitting, employers

Learn more

On August 13, 2012, the U.S. Citizenship and Immigration Services (USCIS) released a bulletin

Learn more

The ProPayroll Employee Handbook Wizard is now available within our HR Support Center. The wizard

Learn more

The ProPayroll paycard includes a great Rewards Program for your employees. Sign up for exciting

Learn more

Speed, going green, reducing paper costs, freeing up physical office space and avoiding shipping

Learn more

Historically, outsourcing payroll has been a necessary evil for many companies focused on their

Learn more

Businesses switch to online payroll companies for improved efficiencies, lower costs and better

Learn more

The Hiring Incentives to Restore Employment (HIRE) Act, also known as the “jobs bill”, that was

Learn more

Human Resources, Latest News,

Human Resources, Latest News,

.png)

.jpg)

.jpg)