Update: As of July 1, 2024 changes have been implemented to the Fair Labor Standards Act. For most up to date information, visit the Department of Labor website or schedule a consultation with Fuse.

The Fair Labor Standards Act set what we know as the 40-hour workweek and established work standards like minimum wage requirements, child labor laws, and overtime pay. While Congress set these standards back in 1938, employers are still accountable to them today. Wage levels and salary thresholds have changed over the years, but the basics of the act still hold true. As an employer or HR manager, keeping up with the many aspects of compliance can feel like a full-time job. That’s why we’ve been working hard to educate you on the various aspects of the FLSA from classifying employees to determining exemptions.

In this article, we will review the FLSA executive exemption and help you determine which employees qualify. In short, the executive exemption means employees whose primary duties comprise managerial tasks are not eligible for FLSA coverage like overtime pay. The roles that typically fall under the executive exemption include CEOs, mid-level managers, and shift managers. But as with anything surrounding government regulations, it’s not that black and white. Many cases have gone to court to debate the details of this exemption. It’s up to Human Resources to learn the details of the exemption so you can classify employees the right way.

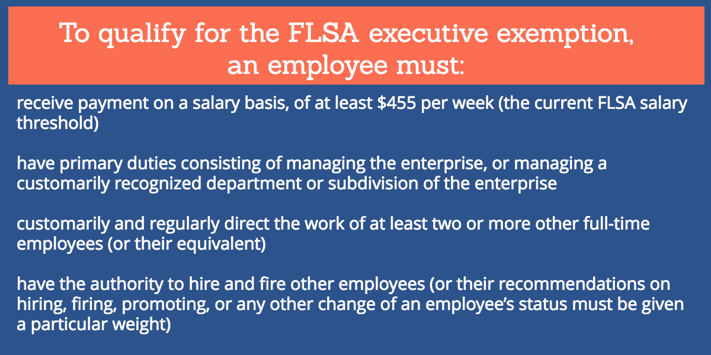

Which employees qualify for the executive exemption?

Additionally, any employee who owns at least a bona fide 20 percent equity interest in the enterprise of employment and is actively engaged in its management, is considered a bona fide exempt executive. The type of business organization (e.g., corporation, partnership, or other) does not matter for exemption qualification.

Executive exemption terms

Now, let’s break down some of the terms used in the criteria for the executive exemption.

Primary duty

This is a term we see in every FLSA duties exemption because it is a primary identifier for qualification. The Department of Labor (DOL) defines primary duties as “the principal, main, major, or most important duty that the employee performs.” It also places the major emphasis on the “character of the employee’s job as a whole.” A primary duty isn’t the same thing as a job title or description. Regardless of what the employee’s job description reads, the DOL evaluates an employee’s primary duties on the actual work the employee does. In the case of the executive exemption, an employee wouldn’t need to have “executive” or “manager” in his or her title to qualify for the exemption. It’s also important to note, as we’ve seen the Court rule, a primary duty isn’t always based on the amount of time spent on the duty but the weight and importance that duty has for the enterprise. We’ll get into this more in the executive exemption examples below.

Management

The employee’s primary duties must consist of managing the enterprise, or managing a customarily recognized department or subdivision of the enterprise. But, different companies will define management different ways. For the purposes of this exemption, we have to look at the DOL’s definition of management.

The DOL considers the following activities included in management duties:

- Interviewing, selecting, and training employees

- Setting and adjusting employee pay rates and hours of work

- Directing the work of employees

- Maintaining production or sales records for use in supervision or control

- Appraising employee productivity and efficiency to recommending promotions or other changes in status

- Handling employee complaints and grievances.

- Disciplining employees

- Planning the work, determining the techniques to be used, and apportioning the work among the employees

- Determining the type of materials, supplies, machinery, equipment, or tools to be used or merchandise to be bought, stocked, and sold

- Controlling the flow and distribution of materials or merchandise and supplies

- Providing for the safety and security of the employees or the property

- Planning and controlling the budget

- Monitoring or implementing legal compliance measures

Customarily recognized department or subdivision

The DOL uses the phrase “customarily recognized department or subdivision” to distinguish between acknowledged, ongoing work with permanent status/function and a collection of employees performing one-time tasks for a specific job. When evaluating this section of an employee’s duties, ask: is the work performed more often than occasionally but less than constant? Is the work done about every workweek and not an isolated task?

FLSA executive exemption example

To better understand the executive exemption, we’re going to look at several examples from the American Bar Association highlighting previous litigation. We will examine how the Courts defined the exemption and its primary duties.

Assistant manager performs both managerial and non-managerial tasks: Gellhaus v Wal-Mart Stores, Inc.

The plaintiff, an assistant manager at Wal-Mart, spent time doing both managerial and non-managerial work. While she interviewed and hired employees and conducted employee coaching (performance reviews), she also spent time stocking shelves and unloading inventory. The plaintiff argued that she spent a significant amount of time doing non-managerial tasks and thus didn’t qualify for the executive exemption.

The court, however, found the plaintiff’s primary duties as managerial tasks. These task included overseeing and directing subordinates, managing inventory and merchandise displays, and recommending hiring, firing, and other changes in employee status. In the end, the Court found that even though the plaintiff did non-managerial tasks, because she managed two or more employees on a regular basis (and met other FLSA exempt requirements), she qualified for the executive exemption.

Assistant manager spends significant time on non-exempt tasks: Buechler v. DavCo Restaurants, Inc.

In a case involving an assistant manager at a fast food chain, the plaintiff argued that he spent a significant amount of shift time performing non-managerial tasks. He also noted that his suggestions for changing employee status were not given weight or relied upon.

Despite these arguments (which the Court did not dispute), the Court ruled the assistant manager did qualify for the executive exemption. Despite the assistant manager’s frequent non-exempt tasks during his shifts, the Court noted that during his shifts, he was the only manager on duty and had sole responsibility for the operation of the restaurant during that time.

Store Manager in title, not duty: Rodriguez v. Farm Stores Grocery

In the case between a grocery chain and some of its employees, the Eleventh Circuit ruled in the plaintiff’s favor. Farm Stores Grocery had over 100 free-standing business locations with around three to six workers at each store. At each store, the grocery gave one employee the title of “store manager” and the other workers “sales associates.” Store managers received pay on a salary basis. Upon review, the Court found that store managers spent about 50% of their time on customer attention or service, 30% on cleaning, 10% on merchandise receiving, and 10% on stocking. That doesn’t leave a lot of time for managerial duties. In fact, several store managers testified that their stores were actually run by district managers. In the end, the Court found that many of the store managers spent at least no time time performing managerial duties during most weeks and it was not the majority of their work.

We can see from these examples that the primary duty carrying the most weight for the enterprise can make a significant impact on an employee’s exempt status. It also shows that an employee’s title does not dictate the exemption. As you classify your employees, pay careful attention to their primary duties and the weight those duties have on your organization.

For more information about classifying your employees with the correct FLSA status and job duties exemptions, visit our FLSA resource page.