Secure Act 2.0 Roth Catch-Up Setup

Overview

Statutory Background: Catch-up contributions must be treated as Roth contributions if made by employees whose wages for the preceding calendar year from the same employer sponsoring the plan exceed $145,000, annually adjusted for inflation.

Once you have completed the following steps, the system will use the preceding calendar year's medicare wages to determine which employees are high earners.

Adding the Deduction Code

- Go to Settings > Payroll Setup > Deduction Codes

- Click the Add New Deduction Code button on the top right

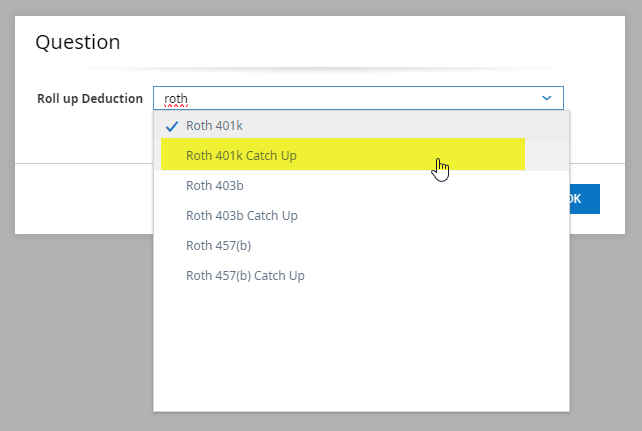

- Choose the appropriate Roth Catch Up Deduction type:

- Click Ok

- The next screen will show the settings for this new deduction code. Please review the data and complete the following items:

- Employee Deduction Frequency = Every Pay

- Company EINs widget = If you are part of a multi-EIN company, you must ensure the correct EINs are attached to this deduction code.

- Review any Lists to see if this new deduction code should be included

Updating Retirement Plan Profiles

- Go to Settings > Profiles/Policies > Retirement Plans

- Click the edit button on each retirement plan row that requires this update. Each will need to be updated separately.

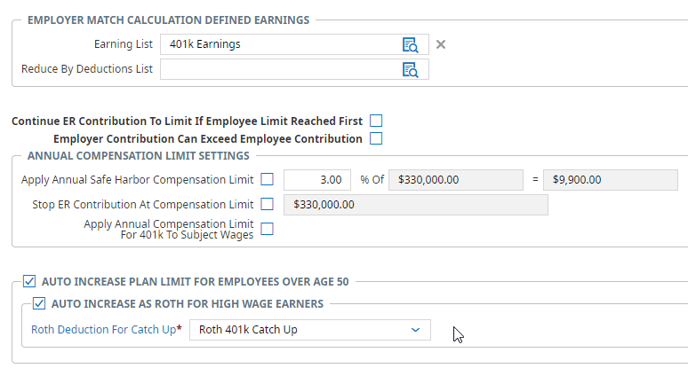

- Under the Auto Increase Plan Limit for Employees Over Age 50 checkbox, you will now see an option for Auto Increase as Roth for High Wage Earners. You will need to mark this new checkbox and attach the new deduction code created.

How this Works

The Roth Catch-Up deduction chosen in the retirement plan becomes a scheduled deduction for the applicable employee at the moment of retirement plan assignment. The system will use the employee's Medicare wages from the previous year to determine whether the employee should be considered a "high-wage earner."

The scheduled deduction will have the amount field grayed out. The deduction amount will be calculated using the pre-tax deductions and what is eligible for catch-up.

The system will handle the catch-up contributions appropriately. If the employee is over the pre-tax limit, the system will stop the original deduction at the non-catch-up contribution limit and begin withholding within the Roth Catch-Up deduction. If the employee is not a "High Wage Earner" and did not surpass the Medicare pre-tax limit in the previous year, then the catch-up

contribution will continue on the original deduction.

The Roth Catch-Up will not be included in pay statements for employees who don't require the catch-up provision (they are not "high wage earners" and 50 or over) but are assigned to this retirement plan.