Payroll Adjustments for Third-Party Sick Pay Amounts

How to enter third-party sick pay (3PSP) adjustments in payroll.

When you receive a report from your insurance carrier with details of the third-party sick pay payments that have been issued to your employees, you need to enter those amounts as adjustments into your payroll. This is necessary to fulfill your employer reporting requirements related to third-party sick pay, including the payment of your employer taxes, even if you have chosen for Fuse NOT to produce and file the third-party sick pay W-2s.

Even if no taxes were withheld from the payments to your employees, the employer needs to report those payments. Both taxable and non-taxable portions of the third-party sick pay payments must be reported.

How do I enter 3PSP adjustments into the payroll?

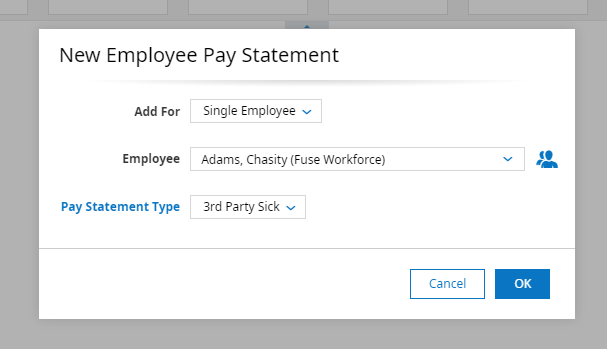

Before entering your third-party sick pay adjustments into payroll, you first need to determine if you are reporting taxable payments, non-taxable payments, or both. If any employee received both taxable and non-taxable payments, you will need to enter their adjustments into payroll using a separate pay statement for each.

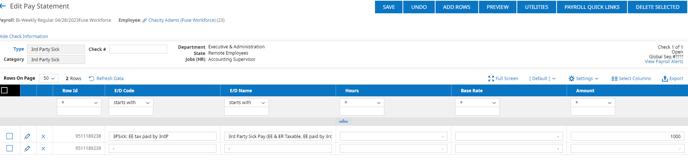

- Taxable Payments

- Use the Pay Statement Type (PST) "3rd Party Sick"

- Within the Pay Statement, use the earning code "3PSick: EE Tax Paid by 3rdP"

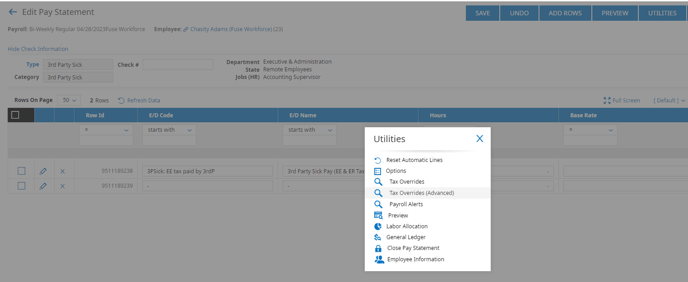

- If the taxes calculated by Fuse do not exactly match the taxes withheld by the third party, use the "Tax Overrides Advanced" Utility to overwrite the tax amounts in the Pay Statement

- Use the Pay Statement Type (PST) "3rd Party Sick"

- Non-Taxable Payments

- Use the Pay Statement Type (PST) "3rd Party Sick"

- Within the Pay Statement, use the earning code "3PSick: Non-Taxable"

If you are entering two 3rd Party Sick Pay Statements for an employee, you must Close the first Pay Statement before creating the second.

For more information on a general understanding of third-party sick pay, please review the following article: Understanding Third-Party Sick Pay