Form W-2 Codes Explained

This article outlines the description of each box on Form W-2 to give you and your employees a better understanding of the amounts and codes on the form.

Boxes A through F

The lettered boxes on a W-2 include the name and address of you and your employer, your Social Security number, and your employer's EIN and state ID number.

Boxes 1 and 2

Box 1 shows your taxable income, including wages, salary, tips, and bonuses, while Box 2 shows how much federal income tax your employer withheld from your pay.

Boxes 3 and 4

Box 3 details how much of your earnings were subject to Social Security tax and Box 4 the amount of Social Security tax that was withheld.

Boxes 5 and 6

Box 5 spells out how much of your pay is subject to Medicare tax and Box 6 how much was withheld. The employee portion of the Medicare tax is 1.45%.

Boxes 7 and 8

If part of your pay is in the form of tips, these boxes show how much you reported in tips (Box 7) and how much your employer reported in tips it paid to you (Box 8).

Box 9

This box was used to reflect a now-defunct tax perk, so it is left empty.

Box 10

Box 10 reports how much you received from your employer in dependent care benefits (if applicable).

Box 11

This box details how much deferred compensation you received from the employer in a non-qualified plan.

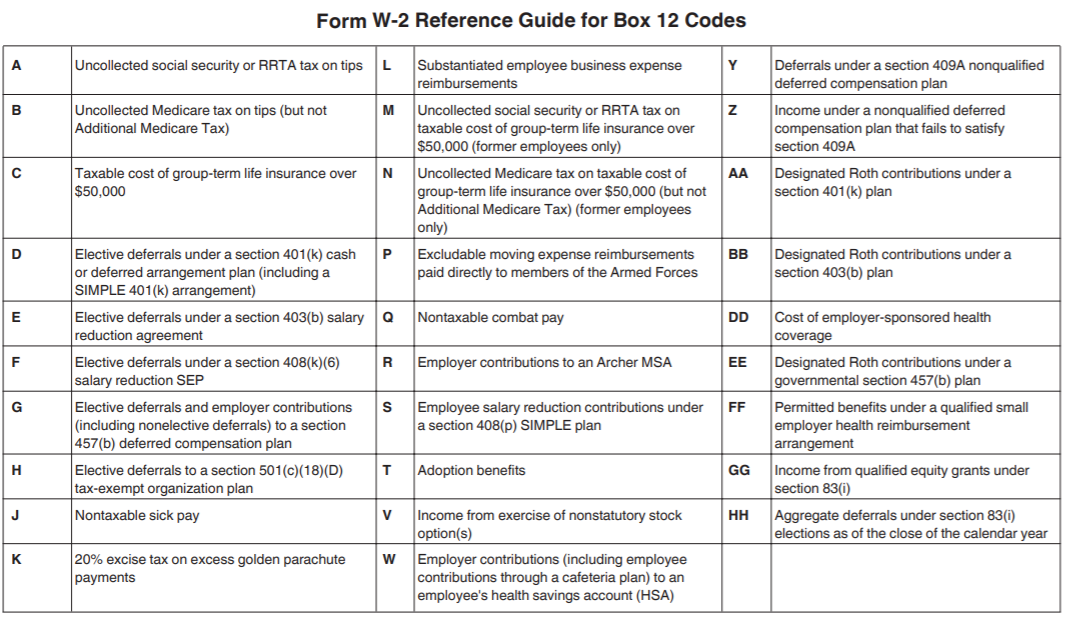

Box 12

Box 12 details other types of compensation or reductions from your taxable income and a single or double letter code that corresponds to each. It might include, for example, contributions to a 401(k) plan. See table below.

Box 13

This box has three sub boxes designed to report pay that is not subject to federal income tax withholding, if you participated in an employer-sponsored retirement plan, or if you received sick pay via a third-party, such as an insurance policy.

Box 14

Box 14 allows an employer to report any other additional tax information that may not fit into the other sections of a W-2 form. A few examples are state disability insurance taxes withheld and union dues.

Boxes 15-20

The last six boxes on a W-2 all relate to state and local taxes, including how much of your pay is subject to these taxes and how much was withheld.