Employee does not work or live in unemployment state

How to clear warning messages regarding employees' not living or working in the unemployment state assigned.

What does this warning mean?

The system automatically calculates state withholding taxes using employees' residential or work location addresses. The Unemployment state, however, must be manually updated in their employee profile.

This warning message states that the current unemployment state applied to this employee does not match their home address state or work location state for this payroll.

How to fix this warning

- If the unemployment state listed in the warning is where the employee works, you will need to verify that they have the correct work location (cost center) address.

- If the employee has recently moved home or work addresses, the unemployment state will need to be updated manually with the effective date of the move.

- Go to the Tax Settings widget of this person's Employee Information screen.

- Go to the State Tab and scroll down to Unemployment

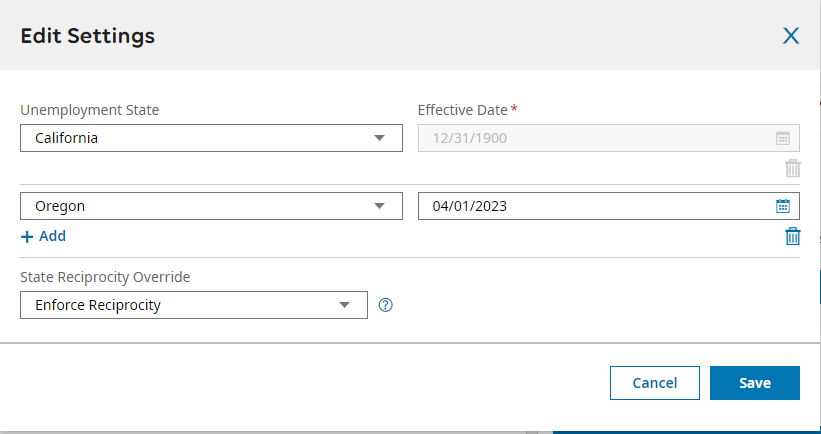

- Click on the Edit link and add your new state settings. In this screenshot, the employee was in California until 4/1/2023, when their unemployment state was overridden to Oregon.

- Click Save

- You will need to recalculate your pay statements to clear the warning message from your payroll.

- If the employee does not currently live or work where they are taxable for unemployment, and this warning is accurate, you can ignore it. This warning does not prevent you from finalizing your payroll.